Information For Municipalities

Information for Fire Districts

Quasi-Public Entity Audit Bid Specifications and Procedures

AUDIT SUMMARY

Ernest A. Almonte, CPA, CFE - Auditor General

Employees' Retirement System

Fiscal Year Ended June 30, 1998

We completed an audit of the Employees' Retirement System of Rhode Island (the "System") for the fiscal year ended June 30, 1998. Benefits are provided under the following plans which comprise the System:

- Employees' Retirement System (ERS) - provides pension benefits to state employees as well as teachers and other employees of local school districts;

- Municipal Employees' Retirement System (MERS) - provides pension benefits to employees of participating municipalities, housing authorities, water and sewer districts, and municipal police and firemen;

- State Police Retirement Benefits Trust (SPRBT) - provides pension benefits to state police and superintendents hired after July 1, 1987; and

- Judicial Retirement Benefits Trust (JRBT) - provides pension benefits to judges appointed after December 31, 1989.

Each plan's assets may be used only for the payment of benefits to members of that plan.

We concluded that, except for the year 2000 issue, the System's financial statements present fairly, in all material respects, the net assets of the plans within the System as of June 30, 1998 and the changes in plan net assets for the year then ended in conformity with generally accepted accounting principles. The System provided note disclosure on its remediation efforts in relation to the Year 2000 issues; however, due to the unprecedented nature of the Year 2000 issues, its effects and the success of related remediation efforts will not be fully determinable until the year 2000 and thereafter. Accordingly, insufficient audit evidence exists to support the System's disclosures with respect to the Year 2000 issues.

We did not find any material instances of noncompliance with laws, regulations and contracts that we are required to report under Government Auditing Standards. We also did not find any matters involving the System's internal control over financial reporting that we considered to be reportable conditions or material weaknesses.

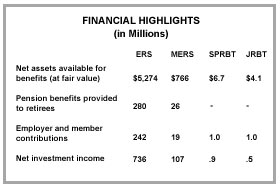

At June 30, 1998, the combined net assets of the plans was approximately $6.1 billion (fair value). Total investment income, including net appreciation in the fair value of the plans' investments during the year, was $845 million.

Benefits paid to retirees and beneficiaries under the plans totaled $306 million while contributions to all plans by both employers and members totaled $263 million.

The financial statements include required supplementary information that provides the progress made, by plan, in accumulating sufficient assets to pay benefits when due.

Key financial highlights for each of the plans are summarized in the table below.

Copies of this audit report can be obtained by calling 222-2435.

Voice 401-222-2435 • Fax 401-222-2111 • Email ag@rioag.gov

State of Rhode Island Web Site

![]()

Last modified